Week ahead August 1st – 5th

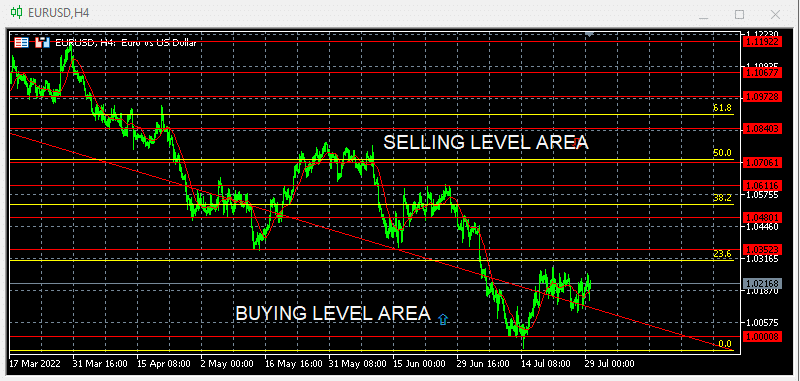

EUR/USD FUNDAMENTALS AND TECHNICAL

Pair closed last week’s trading session unchanged, after a week of tide range trading. The FED hiked rates by 0.75% as it was widely expected. Although the pair did not reacted at this rate hike. As we have previously mentioned this rate kike was already priced in. In Addition, the pair tried to break above 1.0270 during the speech, as FED’s chairman Powell said that with this rate hike the FED has reached the targeted level and will slow down its tightening policy, if any rate hike will follow, it will depend on the economic outlook. Commends were taken as dovish from markets and helped the pair maintained same levels.

As for this week market participants will mainly focus on the non-farm payroll number. After the fed is done with its rate hike aggression, markets will follow a traditional trading, based on market’s economic calendar. Last week’s US gross domestic product shown a slow down in the US economy signaling of a US recession and this is already felt in the pair. Traders will be closely follow the economic releases for any price action.

On the economic calendar, we have on Monday, German retail sales pointing lower at -8% and US ISM Manufacturing PMI lower at 52. On Wednesday, European retails sales expected lower at -1.6% and US ISM services PMI lower at 53.5 On Friday the US non-farm payroll expected to show an additional 250K new jobs

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and turns down will retest 1.0000 If breaks below 1.0000 will accelerate losses down to 0.9900. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0530 (38.2%). Our traders are net 100% long with positions opened between 1.1350 to 1.0000 targeting profits above 1.1350 we are expecting more aggressive long positions on the way down. Alternative if pair continues trading on the upside, we are expecting short sellers to appear around 1.0530 (38.2%)

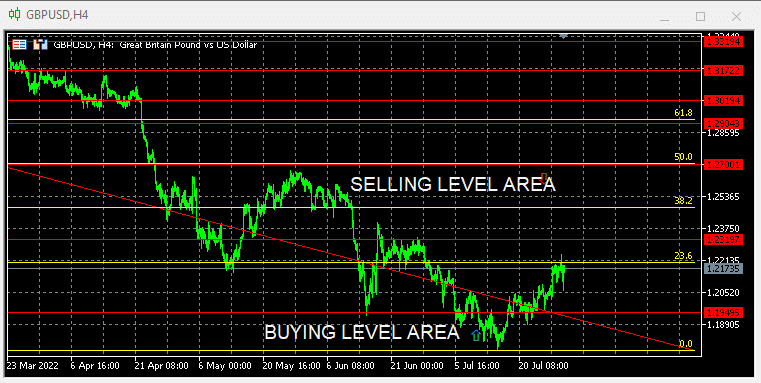

GBP/USD FUNDAMENTALS AND TECHNICAL

Pair closed last week’s trading session higher on US Dollar’s weakness. As it was expected and already priced in, the 0.75% rate hike in the US was the last front-wind for the pair and this helped the pair to continue trading higher for the second week in a row. Comments from FED’s chair Powell highlighting the end of rate hike aggression, helped the pair to continue higher. As Mr. Powell said any rate hike from here on, will depend on how the economy will perform.

As for this week market participants will focus on the BOE rate hike and press conference. The central bank expected to hike rates by 0.25%. this will be a move that will show to traders the willingness of the central bank to fight inflation. If the central bank will hike by 0.5% will be seen as positive and could push the pair sharp on the upside. The non-farm payroll number in the US will be the only thread for the pair.

On the economic calendar we have on Monday the UK Manufacturing PMI to remain unchanged at 52.2 and US ISM manufacturing PMI lower at 52 On Wednesday, composite PMI to remain unchanged at 52.8 and US ISM services PMI lower at 53.5 On Thursday BOE expected to hike rates by 0.25% and the press conference will follow. On Friday the US non-farm payroll expected to show an additional 250K new jobs

Technically the pair is negative after last week’s close below 23.6% In this week’s trading session if pair manages to keep on the upside, we are expecting to test 1.2480 (38.2%) Alternatively if pair resumes downside will retest 1.1800 A break below 0% could accelerate losses down to 1.1700 Our traders are net long 100% with positions opened between 1.3412 to 1.1950 targeting profits above 1.3400 We are expecting more aggressive buyers on the way down and short sellers to appear around 1.2625

For more detailed economic calendar events please visit our live economic calendar on:

http://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TEN.TRADE accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.

You must be logged in to post a comment.